没有国家预算意味着没有治理。该怎么办?

每个国家的经济都包括一个被称为“非正式”的部分,有时可能大于正式部分。非正式经济中的经济活动未记录,而不是由官方账户和统计数据捕获的,是不可见的,没有造成税收的贡献,并使工人没有正常的劳动标准和保护。专家们期望非正式经济会随着生活水平的增长而缩小,但如今,人们普遍认为非正式经济将在这里留下来。

(由Paul van der Molen撰写)

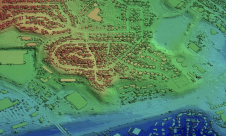

我不欢迎这一前景,因为非正式economies have a negative effect on governance. While I appreciate that, in some countries, citizens might want to hide from their government for good reason, the bottom line is that governments should not miss out on the essential data to formulate evidence-based policies, to generate tax income and to provide decent working conditions. Focusing on the state finances, global statistics show that many states are in a precarious position: government expenditures are financed by remittances, aid and natural resources rents (oil, gas, minerals). The contribution of taxation is very limited; 3 to 5% of GDP is no exception, while expenditure is much higher, say 35%. But remittances may fall, as too may oil prices, and aid is shrinking so relying solely on these sources is risky. A few oil countries have already asked IMF for a bailout. Increasing the tax base appears to be a prerequisite for better governance. This leads us on to the question of how to tackle the problem of the missing information. Which minimum set of data should a country have in place? First of all a civil register is needed, because a government should know about its ‘capita’. As governments are well known for developing records of franchised citizens, this appears to be mainstream business. Similarly, a register of legal bodies is essential to complement the one on natural persons. Then comes the matter of taxation: what to focus on. Taxes on income, profits, imports and exports can be collected on a self-declaration basis, with random checks acting as a deterrent. And which reliable tax base fits easily in a database? Land-based property tax, of course. But recording property requires laws to define what ‘property’ entails and experience has shown that, in countries with pluralistic property arrangements, a synthesis at national level is not easily achieved. Where this is still problematic, one solution is to use possession as the tax base and — for the time being at least — to avoid the property question. Of course, the possessor might be the owner but there is no need for the government to make ownership explicit; it is the possession that counts. Sensitive matters are thus avoided. One dataset is still missing, namely a street address for all so that tax invoices can be delivered. Simply linking an address to a coordinate gives spatial enablement. The fit-for-purpose approach and land administration domain model remain fully applicable, also with possession as a tax base. Thus, with a minimum of four datasets, governments can create their own success. Just a little bit more formalisation is the key.

Paul van der Molen (66) is an emeritus professor in Cadastre and Land Administration of the University of Twente (Faculty ITC) in Enschede (NL) and a former director of Kadaster International in Apeldoorn (NL). He is an honorary member of the International Federation of Surveyors FIG.